The latest news stories of interest in the Rogue Valley and the state of Oregon from the digital home of Southern Oregon, Wynne Broadcasting’s RogueValleyMagazine.com

Monday, February 3, 2025

Rogue Valley Weather

https://graphical.weather.gov/sectors/oregon.php

US National Weather Service Medford Oregon

Sheriff’s Deputies Respond to Shady Cove Armed Robbery, Suspect Located and Arrested within Minutes

JCSO Case 25-0612 – SHADY COVE, Ore. – A suspect is in custody after using a firearm to rob a Shady Cove business this evening. Sunday, February 2 at 5:44 PM, ECSO 911 Dispatch received a call for an armed robbery at Burgers & Brews restaurant in the 21170 block of Highway 62 in Shady Cove.

Jackson County Sheriff’s Office (JCSO) deputies responded along with Eagle Point Police Department officers. Deputies located the suspect vehicle at 5:55 PM at the Shady Cove Chevron gas station. After a brief standoff, deputies arrested the suspect without incident at 6:02 PM.

The suspect, Jonathan Allen Rusch, 24, of Fond Du Lac, Wisconsin, is charged with first-degree robbery, menacing, and unlawful use of a weapon. He was booked and lodged in the Jackson County Jail.

This case is under further investigation. There is no additional information for release at this time.

The Britt Festival Orchestra (BFO) announces its 2025 season, with three weeks of exciting outdoor programming in historic Jacksonville, Oregon, June 12 – 28, 2025.

Under the leadership of four guest conductors, Damon Gupton (June 12-13); Chia-Hsuan Lin (June 15-18); Roberto Kalb (June 21-23); and Normal Huynh (June 26-28) the Orchestra’s 63rd season highlights a feature film alongside beloved classical favorites.

The season features seven extraordinary guest artists: pianist Clayton Stephenson performing Ravel’s Concerto in G Major; violinist William Hagen performing Korngold’s Concerto in D Major; violinist Tessa Lark and cellist Wei Yu performing Brahms Double concerto for Violin & Violoncello in A minor; vocalist Sun-Ly Pierce performing Ravel’s Shéhérazade; pianist Jaeden Izik-Dzurko performing Rachmaninoff’s Concerto No. 3 in D minor; and violinist Simone Porter performing Stravinsky’s Violin Concerto in D and Ravel’s Tzigane. The season will begin with two evenings of Jurassic Park in Concert whereJohn Williams’ score will be performed live-to-picture by the full orchestra in one of the most beloved films of the 20th Century.

Britt Music & Arts Festival shares extraordinary live performances and arts education experiences that inspire discovery and build community, anchored at the Britt hill amphitheater. Since its grassroots beginnings in 1963, the non-profit organization has grown from a two-week chamber music festival to a summer-long series of concerts in a variety of genres, including a three-week orchestra season, and year-round education and engagement programs. For more information, visit www.brittfest.org

The Jackson County Expo announced its 2025 summer concert lineup taking the stage during the Jackson County Fair in July.

According to the Expo, musical acts including Outlaw Mariachi, Jo Dee Messina, and a Taylor Swift tribute will take the stage in Central Point this summer.

The Jackson County Fair runs from July 15 through July 20. Fair tickets start at $12 and include lawn seats at the Bi-Mart Amphitheater.

Concert ticket prices start at $25 and go on sale to the public on Tuesday. Fair admission is included with the purchase of a reserved seat.

Full 2025 Jackson County Fair Concert lineup:

Tuesday, July 15 – Outlaw Mariachi

Wednesday, July 16 – Jo Dee Messina

Thursday, July 17 – Kansas

Friday, July 18 – Skillet

Saturday, July 19 – Are You Ready For It? A Taylor Experience

For more information or to purchase a ticket, visit the Jackson County Expo’s website: https://attheexpo.com/fair/

𝟭𝟮 𝙎𝙪𝙨𝙥𝙚𝙘𝙩𝙨 𝘼𝙧𝙧𝙚𝙨𝙩𝙚𝙙 𝙁𝙤𝙡𝙡𝙤𝙬𝙞𝙣𝙜 𝙋𝙧𝙤𝙖𝙘𝙩𝙞𝙫𝙚 𝙍𝙚𝙩𝙖𝙞𝙡 𝙏𝙝𝙚𝙛𝙩 𝙀𝙣𝙛𝙤𝙧𝙘𝙚𝙢𝙚𝙣𝙩 𝙊𝙥𝙚𝙧𝙖𝙩𝙞𝙤𝙣

Grants Pass Homeless Policies Face New Court Challenge

After Grants Pass city officials shut down a homeless camp and restricted camping to one site, they face a lawsuit from five homeless residents and advocacy groups

Two advocacy groups and five homeless people sued Grants Pass on Thursday in a bid to force the southern Oregon city to change its restrictions on homeless camping that put people with disabilities and others in peril.

Disability Rights Oregon and the Oregon Law Center filed the emergency lawsuit in Josephine County District Court. It seeks an immediate temporary restraining order that prohibits the city from enforcing its current ordinances and policies towards homeless people. The city has limited homeless people sleeping outside to just one site, which is overcrowded and lacks drinking water. It also forces people, including those with disabilities, to pack up their tent and leave at 7 a.m. each morning before returning at 5 p.m., the lawsuit said. Violators face $75 citations.

The lawsuit comes almost seven months to the day after after the U.S. Supreme Court ruled that the city can impose criminal penalties on illegal homeless camping without violating constitutional provisions against cruel and unusual punishment.

The new case argues that Grants Pass does not follow requirements in Oregon state law. Last year, after the Supreme Court ruling, city officials designated two sites for homeless people to camp in August.

On Jan. 7, city officials decided to close the larger of two designated camping sites, which held about 120 tents. Only one site remains that can have about 30 tent sites at any time. And now, tents can only be there from 5 p.m. to 7 a.m. each day.

“Putting the lives of people with disabilities at risk in the dead of winter because they don’t have housing is cruel and illegal,” said Jake Cornett, executive director & CEO of Disability Rights Oregon. “Without adequate shelter space available, forcing a person in a wheelchair or someone with a chronic illness to pack and move their belongings daily is not just impossible, it’s inhumane. Grants Pass’s dangerous actions must be stopped.”

Grants Pass city officials did not immediately respond to a request for comment on the lawsuit.

The lawsuit alleges the city’s policies violate state laws that prohibit discrimination based on disability. It seeks a temporary restraining order and permanent injunction that prohibits the city from enforcing its current ordinances for homeless camping. The lawsuit, if successful for plaintiffs, would force the city to adopt new ordinances that regulate camping and sleeping by homeless in a different way, with fewer restrictions and impacts.

For the homeless people named in the lawsuit, the impacts of the city’s policies are acute.

‘I’m a human being’

One of them is Janine Harris, 57, who suffers from arthritis, vertigo and chronic headaches. For years, she worked as a caregiver until health problems made her physically unable to do so.

Homeless now for four years, arthritis in her hips and knees forces her to use a cane.

“I’m not afraid of work,” she said. “I just can’t do it anymore. I’m physically unable to do it anymore.”

She is too weak to carry anything and has to use a wagon to cart her belongings around.

She never knows where she is going to stay.

To set up her tent, which is in storage, would take her an hour, so she’s more inclined to sleep without it.

“With my luck, it’d probably just be best to open up my cot and put the blankets on and pray I get no rain,” she said in an interview.

She asks Oregonians to remember people like her, who fell into homelessness through no fault of their own.

“I just want people to realize that I’m not a monster,” she said. “I’m a human being, and I have a right to be treated as one. I put my dues in. I’ve worked my ass off.”

Another plaintiff is Jeffrey Dickerson, 57, who worked in construction until 2006, when an aneurysm sidelined him and ended his career. Since then, he has bounced from homelessness on the streets, living with a friend and renting a room. With a $967 Social Security disability check each month, he cannot find an affordable place to live and has been homeless, most recently, for nearly a year.

He has chronic nerve pain in his hands and feet, arthritis in his neck and walks with a cane. Once, his cane was stolen when he left it outside his tent.

At the campsite, he awoke one morning ahead of the 7 a.m. deadline to pack up and found his tent’s zipper was frozen shut. He had to break it to get out. Outside the tent, he has to walk with his cane over gravel to reach the portable toilet.

He no longer has a tent and carries an olive green backpack. He keeps his sleeping bag stowed away out of sight.At night, he looks for somewhere to sleep, often outside the campsite. “I don’t see how they could let that happen,” he said. “It’s inhumane.” (SOURCE)

Grants Pass Police Arrest 2 Juveniles for Kidnapping and Other Serious Felonies

Following an extensive investigation involving numerous victims, Grants Pass Police Detectives, assisted by patrol officers, served a search warrant early Thursday in the Northwest area of Grants Pass. This resulted in the arrest of two juvenile males, ages 14 and 15. Their identities are confidential at this time based on their juvenile status.

The pair was arrested for a lengthy list of severe felonies and misdemeanors, including 1st Degree Kidnapping, Strangulation, 2nd and 3rd Degree Assault, Unlawful Use of a Weapon, Unlawful Possession of a Firearm, Menacing, and Criminal Conspiracy. One of the juveniles was additionally arrested for 1st Degree Theft.

Both male juveniles were lodged at the Josephine County Juvenile Justice Center following their arrest.No further details can be released at this time as the investigation remains ongoing.

Man Arrested for Assault, Felony Hit & Run After Striking Woman Walking Horse on Rural Rogue River Roadway

ROGUE RIVER, Ore. — A suspect is in jail and a victim is in the hospital after a hit and run crash Sunday night on a rural Rogue River roadway. On Sunday, January 26 at 5:51 PM, a vehicle struck a woman in the roadway in the 700 block of Queens Branch Rd. The woman was attempting to gain control of her horse at the time of the crash. The vehicle never stopped and fled the scene at a high rate of speed. The woman was transported to an area hospital with major injuries but is in stable condition. The horse was not injured.

Multiple witnesses were on scene at the time of the crash and provided information to responding Jackson County Sheriff’s Office (JCSO) deputies and Rogue River Police Department officers. Later Sunday night, JCSO deputies received a report of a stolen vehicle in the nearby area. Evidence on scene led deputies to connect the reported stolen vehicle to the crash. After further investigation, deputies determined the involved vehicle was not stolen and the suspect had initiated a false report.

JCSO deputies arrested the suspect Tuesday, January 28 just after 6 PM. The suspect, Jason Allan Baker, 40, of Rogue River is charged with second-degree assault, felony hit and run, reckless driving, recklessly endangering another person, tampering with evidence, aggravated driving while suspended, and initiating a false police report. He is lodged in the Jackson County Jail. There is no further information available for release at this time.

Upper Rogue River Users, Look for New Signs for Boat Operations

The Oregon State Marine Board passed new rules for boat operations on the Upper Rogue River during its quarterly January 23rd Board meeting. The rules go into effect on February 1, 2025.

Temporary signs will be installed by January 31 at the following boating access sites:

- Fishers Ferry County Park

- TouVelle State Park

- Dodge Bridge County Park

- Takelma County Park

- Upper Rogue Regional County Park

- Rogue Elk County Park

- Casey County Park

- McGregor Park Boat Ramp

Permanent signs with graphics outlining specific rule segments on the river are in development and will replace the temporary signs by the spring.

The Marine Board will ramp up education and outreach efforts during the first year of rule implementation.

To stay up to date on the agency’s outreach, follow Boat Oregon on social media (Facebook, Instagram), or subscribe to Boat Oregon News and learn more about the rules from the agency’s Public Meetings page.

Oregon Housing And Community Services Awards Funding To Jackson County Wildfire Survivor To Buy A New Home

Oregon Housing and Community Services

First recovery grant from the Homeowner Assistance and Reconstruction Program

— A Jackson County wildfire survivor is in a new home after becoming the first homeowner to receive funding from the ReOregon Homeowner Assistance and Reconstruction Program (HARP). The program’s funding comes from the federal $422 million Community Development Block Grant Disaster Recovery to help Oregonians and communities recover from the 2020 Labor Day Disasters.

The new three-bedroom, two-bath manufactured home is a chance to start fresh and get back a sense of normalcy. “I can finally breathe again,” said Joan, which is not the homeowner’s real name as they did not want to be identified. “I’m safe. I’m secure… It’s hard to explain, but I finally feel like I can hit the un-pause button. I can finally begin where I left off.”

HARP, a federally funded program launched in 2024, provides qualified homeowners whose properties were damaged by the wildfires and straight-line winds in fall 2020 with financial assistance to repair, rebuild, or replace their homes. This homeowner chose the Home Purchase Pathway, which allows eligible survivors to buy a stick-built or manufactured home that is already installed.

“This is exactly what these funds were meant to do,” said Shannon Marheine, director of Disaster Recovery and Resilience at Oregon Housing and Community Services (OHCS). “Although we know it’s taken longer than anyone hoped, this is just the first of many recoveries that will come from all of the hard work that OHCS, our partners, and the survivors themselves have put in over the years.”

OHCS has received hundreds of HARP applications for assistance from every county affected by the disasters, and staff continue to review them for eligibility.

“There were so many friendly and supportive people from start to finish with the HARP application,” Joan said. “The professionalism and communication were appreciated and supportive. They were always in touch and leading me to the next step.”

To read more about Joan’s story, visit https://apps.oregon.gov/oregon-newsroom/OR/OHCS/Posts/Post/A-wildfire-survivor-story-of-loss-support-and-recovery-in-her-own-words.

OHCS encourages survivors of the 2020 Labor Day Disasters, who have not yet applied, to fill out an eligibility questionnaire at https://www.oregon.gov/ohcs/disaster-recovery/reoregon/harp/Pages/harp-eligibility-questionnaire.aspx.

To learn more about HARP and other ReOregon programs, visit re.oregon.gov, sign up to receive e-mail notifications, or contact the Call Center at 877-510-6800 or 541-250-0938.

About Oregon Housing and Community Services (OHCS)

OHCS is Oregon’s housing finance agency. The state agency provides financial and program support to create and preserve opportunities for quality, affordable housing for Oregonians of low and moderate income. OHCS administers programs that provide housing stabilization. OHCS delivers these programs primarily through grants, contracts, and loan agreements with local partners and community-based providers. For more information, please visit: oregon.gov/ohcs.

Click It or Ticket Campaign Gears Up

Oregon Department of Transportation has funded a high visibility seat belt enforcement event that began on January 27 and goes through February 9. Local law enforcement agencies in Southern Oregon will provide additional enforcement during that period.

The agencies are reminding drivers about the lifesaving benefits of wearing a seat belt and proper child safety restraints. The Oregon laws regarding child safety include requirements that children ride in a rear-facing safety seat until they are at least two years old. A child over age two must continue to ride in a car seat with harness or in a booster until they reach age eight or 4’ 9” in height and the adult belt fits them correctly. The requirements better protect the child’s head, neck, and spine from potential crash injuries. This is because a rear-facing seat spreads crash forces evenly across the seat and child’s body while also limiting forward or sideways motion of the head.

Seat belts are the best defense against impaired, aggressive, and distracted drivers. Being buckled up during a crash helps keep you safe and secure inside your vehicle; being completely ejected from a vehicle is almost always deadly.

For more information on the Click It or Ticket mobilization, please visit www.nhtsa.gov/ciot. Online Resources:• Car Seat Types: Determine whether your child fits best in a rear-facing car seat, forward-facing car seat, booster seat, or seat belt.• Car Seat Recommendations: Review NHTSA’s recommendations for the best car seat for your child’s age and size. • Find and Compare: Find and compare car seats with NHTSA’s handy car seat finder, which also searches specific brands.

Oregon Department of Transportation Seatbelts and Child Seats: https://www.youtube.com/watch?v=NFC2K2AfdJMMore ODOT information on safety belts and child seats at: http://www.oregon.gov/ODOT/TS/Pages/safetybelts.aspx

The Southern Oregon Chinese Cultural Association has organized a spectacular celebration for Chinese New Year 2025

The celebration will take place at several venues, including Jacksonville’s New City Hall, Community Center, Library, and the Miners’ Bazaar. This multi-venue event aims to make the celebration accessible and engaging for people of all ages. Whether you are familiar with Chinese customs or experiencing them for the first time, there will be something for everyone to enjoy.

While Chinese New Year celebrations are widespread in major cities like San Francisco and New York, Southern Oregon’s observance is unique in its own right. The Southern Oregon Chinese Cultural Association, founded to preserve and promote Chinese culture in the region, has been hosting such events for many years, providing a rare opportunity for local communities to learn about and celebrate Chinese heritage. The celebration in Jacksonville is an example of how this tradition has blossomed in a small town, thanks to the efforts of cultural preservationists and the local Chinese-American community.

Almost 90 non-profits in the region and several organizations that serve multiple counties are getting more than $750,000 from the Cow Creek Umpqua Indian Foundation (CCUIF).

CCUIF has awarded over $25 million across Douglas, Jackson, Josephine, Klamath, Coos, Lane, and Deschutes counties since it was established in 1997.

Carma Monorich of the Tribe says “The work of non-profit organizations is tireless and highly important to our communities. The Asante Foundation, Hearts with a Mission, the Boys and Girls Clubs of the Rogue Valley, Rogue Valley Farm to School, and Rogue Retreat, to name a few, are each getting $10,000.

CASA of Jackson County is getting $12,000 to train new mentors for kids in foster care. Additionally, Medford’s Compass House is getting $7,500 to help support staff who work directly with mentally ill individuals.

Sheriff’s Office issues advisory about motorhome and possible link to missing Prospect woman Deenah Padgett

The Jackson County Sheriff’s Office (JCSO) is asking for help identifying the owner a motorhome. It could be associated with a missing person from the Prospect area.

JCSO says 68-year-old Deenah Padgett has been missing since August 30 from Prospect, described as a white woman, 4’ 8” tall, weighing approximately 95 pounds with brownish red/greying hair.

JCSO issued an advisory this weekend asking anyone with information about the owner of the pictured motor home or Padgett’s whereabouts to call Emergency Communications of Southern Oregon (ECSO) dispatch non-emergency phone number at 541-776-7206.

Did you get help from FEMA, insurance, or others after the 2020 Almeda and South Obenchain Fires?

Hearts with a Mission, a program to help local seniors who need assistance, is seeking volunteers.

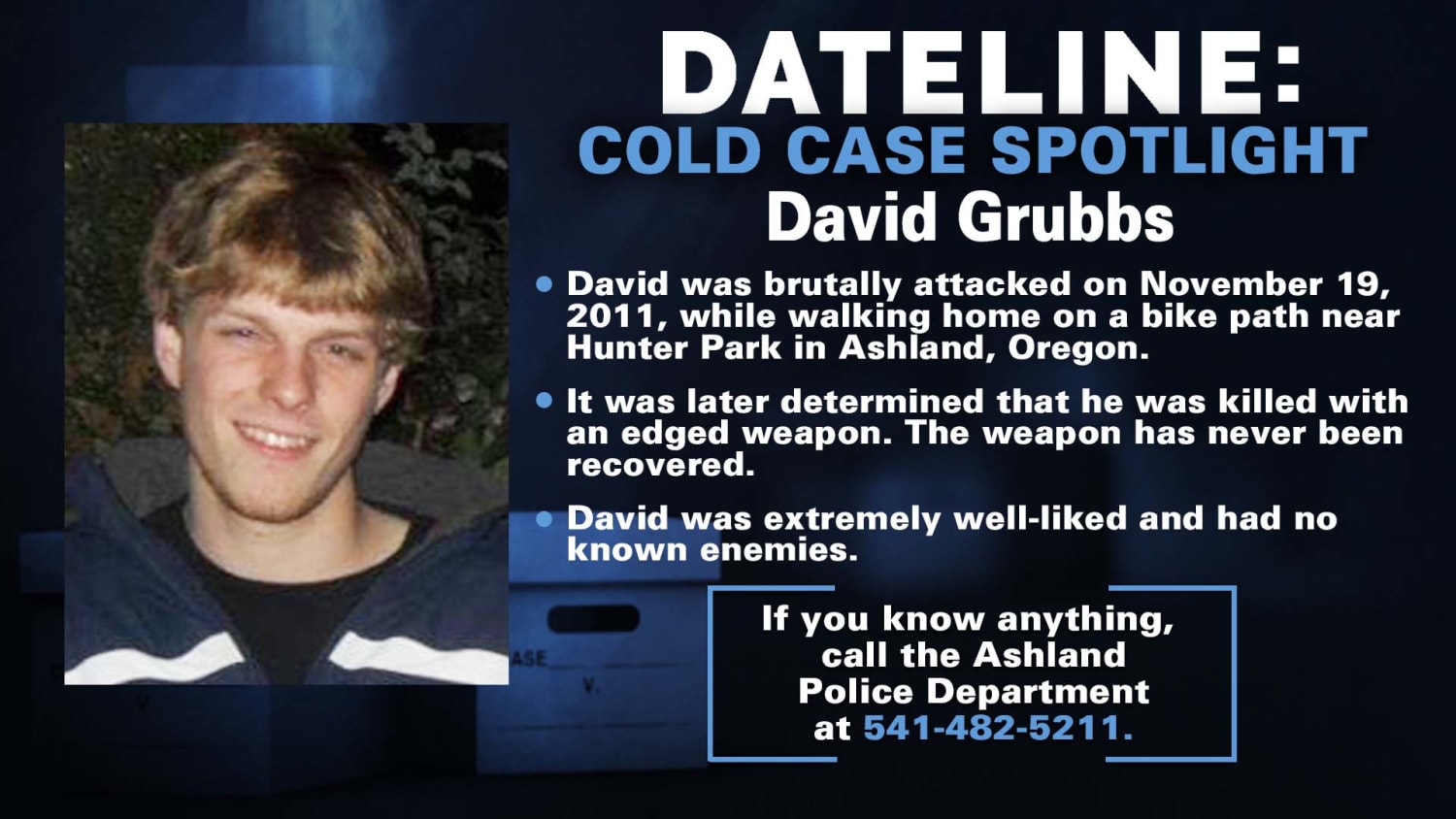

David Grubbs’ Murder Investigation Remains Active

The Ashland Police Department’s investigation into the murder of David Grubbs on November 19, 2011 remains open and active. Recently two new detectives have been assigned to look into new leads that have come in.

The Ashland Police Department’s investigation into the murder of David Grubbs on November 19, 2011 remains open and active. Recently two new detectives have been assigned to look into new leads that have come in.

It’s going on five years now since Fauna Frey, 45, disappeared in Josephine County on a road trip, June 29, 2020, following her brother’s death

PART 2 – Newsweek Podcast Focusing on The Disappearance of Fauna Frey From Lane County

Here One Minute, Gone the Next —– PART 2 – Josephine County Sheriff Dave Daniel joins investigative journalist Alex Rogue to speak with Here One Minute, Gone the Next about the disappearance of Fauna Frey, the growing friction between citizen investigators and law enforcement, and the lack of resources in missing persons cases. https://podcasts.apple.com/us/podcast/the-disappearance-of-fauna-frey-pt2-feat-sheriff/id1707094441?i=1000630100040 PART 1 – John Frey joins Newsweek to discuss exclusive details about the case of his missing daughter that until now have been unavailable to the general public. READ MORE HERE: https://www.newsweek.com/exclusive-what-happened-fauna-frey-new-clues-uncovered-1827197?fbclid=IwAR3Z3Glru5lIgqiYXbs_nA1Fj8JuCIzM11OHSVHfwIucfq2f_G5y9y5bnmQ If you have any information on the whereabouts of Fauna Frey, call the anonymous tip line at 541-539-5638 or email FindFaunaFrey@gmail.com. —- Help Find Fauna Frey #FindFaunaFrey FACEBOOK GROUP

Oregon’s Senator Wyden Sounds Alarm Over Elon Musk’s Access to Sensitive Treasury Payment System

In a news release, Wyden confirmed that he had sent Treasury Secretary Scott Bessent a letter outlining his concerns over the potential for political interference in the operation of these crucial payment systems.

Highlighting the economic risks and the imperative reasons the payment system cannot fail, Wyden said, “Any politically-motivated meddling in them risks severe damage to our country and the economy.”

Managed by the Bureau of the Fiscal Service, the treasury payment system distributes trillions of dollars annually, which fund essential state functions such as Social Security and Medicare benefits, tax credits, and payments to government contractors.

Wyden made several specific requests for details of any access granted to Musk-affiliated personnel, the legal authority for such access, measures taken to ensure the integrity and security of the payment systems, and other issues.

He also questioned whether background checks were conducted on those seeking access and whether potential conflicts of interest in light of Musk’s business dealings in China were considered.

Musk’s significant business operations in China were addressed, including China’s history of cyber espionage targeting U.S. government systems.

Wyden warned that conflicts of interest could arise from Musk’s Chinese business ties. A national security risk could occur if Musk-affiliated access were granted to the sensitive payment systems.

Another concern is that the federal government currently relies on accounting maneuvers to meet its obligations after reaching its debt limit, adding to the financial strain. The Treasury Department had not responded by the time of publication.

Merkley, Wyden Blast President Trump’s Illegal Federal Funding Cuts That Harm American Families

– Oregon’s U.S. Senators Jeff Merkley and Ron Wyden today issued the following statements in response to a federal judge blocking the Trump Administration’s executive order immediately stopping all federal loans and grants:

“The attack on these programs that allow families to get on their feet and thrive is the great betrayal coming from President Trump, who campaigned on helping working families, said Merkley, Ranking Member of the Senate Budget Committee and a senior member of the Senate Appropriations Committee. “In addition, Trump’s order cutting federal funds will have a huge impact on critical infrastructure projects in Oregon—like the Hood River-White Salmon and I-5 bridge replacement projects and the Port of Coos Bay’s transformative container port project—as well as funding to mitigate and fight wildfires, fulfill our commitments to Tribal communities, ensure clean air and water, and protect our public lands and wildlife.During the chaos caused by Trump’s constitutional crisis, Oregonians called my office after being shut out of their federal reimbursement systems and cut off from funding for their work to provide affordable housing, Head Start programs, and health care at federally qualified health centers. I’ll keep fighting to block these illegal cuts.”

“Chaos is not leadership. Ransacking resources from Oregonians counting on federal support for local law enforcement, schools, small businesses, firefighters, veterans, and more hurts each and every community I am honored to represent,” said Wyden, Ranking Member of the Senate Finance Committee. “Donald Trump ran on lowering prices for families, and instead he’s intentionally driving the economy into the ground, forcing all Americans who aren’t Elon Musk to accept a lower standard of living to help he and his buddies get richer and richer. Legal or not, he doesn’t care. This illegal unconstitutional act is now in a court of law, but it’s already playing out in the court of opinion with Oregonians voicing their outrage. The American people must keep the pressure on until every community counting on this funding is assured they will receive it just as Congress intended.”

According to the Oregon State Legislature, about 30% of Oregon’s budget is supported by federal aid, which is critical for supporting local communities. If allowed to go into effect, the directives in President Trump’s executive order could block funding in Oregon for:

- PUBLIC SAFETY: Grants for law enforcement departments would cease to go out the door, undermining public safety in Oregon.

- FIREFIGHTING: Grants to support firefighters would be halted—this includes grants that help states and localities purchase essential firefighting equipment.

- HEALTH SERVICES: Over $106 million in federal funding for community health centers that provide health care for people across Oregon would be at risk, creating chaos for patients trying to get their prescriptions, a regular checkup, and more.

- TRIBES: Funding to Tribes for basic government services like health care, public safety, programs, Tribal schools, and food assistance would be halted.

- HEAD START: Funding for Head Start programs that provide comprehensive early childhood education for almost 10,000 children in Oregon would be at risk. Teachers and staff would not get paid, and programs may not be able to stay open.

- COMBATTING FENTANYL CRISIS: Funding for communities to address the substance use disorder crisis and combat the fentanyl crisis would be cut off.

- CHILD CARE: Child care programs in Oregon and across the country would be at risk to accessing the funding they rely on to keep their doors open.

- K-12 SCHOOLS: Federal funding for our K-12 schools would be halted, preventing school districts in Oregon from accessing key formula grant funding including Title I and nearly $160 million in IDEA Grants (which help children with disabilities). This would pose tremendous financial burdens on schools in the middle of the school year.

- INFRASTRUCTURE PROJECTS: Federally-funded transportation projects in Oregon and across the country—roads, bridges, public transit, and more—would be halted, including projects already under construction.

- EMERGENCY PREPAREDNESS: Critical preparedness and response capability funding used to prepare for disasters, public health emergencies, and chemical, biological, radiological, or nuclear events would be frozen.

- DISASTER RELIEF: Public assistance and hazard mitigation grants from the Disaster Relief Fund to state, Tribal, territorial, and local governments and non-profits to help communities quickly respond to, recover from, and prepare for major disasters would be halted—right as so many communities are struggling after severe natural disasters.

Oregon joins lawsuit while state officials scramble to respond to Trump order freezing federal funds

Oregon is suing the Trump administration after it ordered an abrupt freeze of many federal payments, leaving state agencies unable to access reimbursements for Medicaid and child care programs and sending state officials scrambling to determine the total effect.

Gov. Tina Kotek and Attorney General Dan Rayfield, both Democrats, announced the suit during a brief press conference Tuesday afternoon. Rayfield joined Democratic attorneys general across the country to file the suit in U.S. District Court in Rhode Island following a Trump administration memo directing all federal agencies to “temporarily pause” awarding or disbursing any federal funding that could be impacted by a host of recent executive orders by 2 p.m. Pacific time Tuesday.

“When federal funds that are meant to serve the most vulnerable are suspended or unavailable, that has an impact on Oregonians and it’s a dereliction of the federal government’s duty to protect Americans,” Kotek said.

A federal judge based in Washington, D.C., paused enforcement of Trump’s order until Monday in response to a separate lawsuit filed by a group of nonprofit agencies. And U.S. Rep. Andrea Salinas condemned Trump’s move as an “illegal theft” of taxpayer dollars.

“With the stroke of his pen, President Trump is ordering an unprecedented steal that will take critical resources away from our police, firefighters, veterans, growers, and working families here in Oregon and across the country,” she said. “Oregonians will immediately feel the effects of Trump’s steal at a time when most folks are already struggling to pay the bills and put food on the table.” — (SOURCE)

JOINT STATEMENT ON MEDIATION BETWEEN PROVIDENCE AND OREGON NURSES ASSOCIATION

At the request of Oregon Governor Tina Kotek, the Oregon Nurses Association and Providence Oregon have agreed to have representatives from both sides re-engage in intensive, in-person mediation beginning January 29th, 2025, in an effort to end this strike. Both sides are engaging in every effort to get this dispute resolved as expeditiously as possible and get people back to work.

See Video from 1/31/25 here: https://www.facebook.com/OregonNursesAssociation/videos/1014312273856316

The Oregon Department of Revenue is encouraging all workers with income in 2024 to check their EITC eligibility.

The Department of Revenue is working with other state agencies and community partners to encourage taxpayers to learn more about this credit and find out if they’re eligible for the credit, which is celebrating its 50th year in 2025. The IRS estimates that nearly 25 percent eligible Oregon taxpayers are not claiming the EITC. One Oregon organization says that adds up to an estimated $100 million in unclaimed credits. While many are unaware of the EITC and other credits, another hurdle is the need for free help filing tax returns. Free tax filing assistance is available at sites across the state.

The Earned Income Tax Credit is a federal tax credit for people for making up to $66,819 in 2024. Families may be eligible for a maximum refundable credit of $7,830 on their federal tax return, and a maximum Oregon Earned Income Credit of $940 on their state tax return. Certain taxpayers without children may also be eligible for these credits. Individuals may qualify for the Earned Income Tax Credit, the Oregon EIC, and other credits, even if they are not required to file. To receive the refundable credits, however, they must file a federal and state tax return.

An Oregon House bill would allow retailers to legally scan ID for people buying tobacco or alcohol, regardless of their age.

The legislation follows a pair of lawsuits challenging the practice, claiming universal ID checks were against existing state law and an invasion of privacy.

In September, KGW reported on the growing number of retailers who implemented universal ID checks for alcohol or tobacco products. Jonathan Polonsky, CEO of Plaid Pantry, said the policy of carding everyone eliminated any guesswork and kept the company in compliance with state and local requirements. Oregon law prohibits the swiping of a driver’s license except under certain circumstances, including the sale of age-restricted products if there is any reasonable doubt that the person is 21. Reasonable doubt exists if the person appears to be under the age of 26, according to Oregon Administrative Rules.

House Bill 2055 is headed to the House Judiciary Committee. Even if it is adopted, the bill won’t settle the existing lawsuits over ID checks because it’s not retroactive.

Officials warn SNAP users to prevent fraud

Oregonians who receive supplemental federal food benefits need to be more vigilant than ever against fraud, officials say: If their monthly benefits are stolen, they’ll be gone for good.

In the past, the federal government replaced benefits lost to fraud, but that policy changed late last year. The federal government is no longer replacing stolen benefits from the Supplemental Nutrition Assistance Program.

That could mean a total loss of tens of thousands of dollars in SNAP benefits in Oregon, primarily through “skimming,” according to officials from Partners for a Hunger-Free Oregon. That happens when a device is inserted into a credit card reader and steals financial information when the card is run through the reader.

Only a small minority lose their benefits this way. Oregon has nearly 447,000 households receiving SNAP benefits. From Oct. 1 through Dec. 20, nearly 200 households had their benefits stolen, losing $77,000 in food aid.

The average household receives $310 in SNAP benefits, which are not meant to foot an entire food bill, but the money is often crucial for those who need it.

Jake Sunderland, press secretary for the Oregon Department of Human Services, said SNAP users should take several precautions to protect themselves from fraud:

- Only manage your account through the ebtEDGE website or mobile app, which can be downloaded from the Apple App Store or Google Play.

- Freeze your card right away after each use and unfreeze it before you make purchases and block purchases made outside of Oregon or online through Cardholder.ebtEDGE.com.

- Keep your PIN secret and cover the keypad when you enter it.

- Check your account activity regularly and cancel your card immediately if you see purchases you didn’t make. (SOURCE)

Oregon joins lawsuit over Trump attempt to end birthright citizenship — Judge grants request to temporarily block Trump’s birthright citizenship order

A federal judge in Seattle on Thursday temporarily blocked President Donald Trump’s executive order seeking to end birthright citizenship.

U.S. District Court Judge John Coughenour’s ruling in a case brought by Washington, Oregon, Arizona and Illinois is the first in what is sure to be a long legal fight over the order’s constitutionality.

Coughenour called the order “blatantly unconstitutional.”

“I have difficulty understanding how a member of the bar could state unequivocally that this is a constitutional order,” the judge told the Trump administration’s attorney. “It boggles my mind.”

Coughenour’s decision came after 25 minutes of arguments between attorneys for Washington state and the Department of Justice.

State lawmakers are considering banning winners of large prizes in the Oregon Lottery from reselling their tickets in order to block schemes that enable tax evasion and uncollected child support payments.

The sales practice has spawned a cottage industry of so-called lottery discounters who operate around the state. They annually buy millions of dollars in winning tickets – mostly video lottery and keno tickets with prizes above $1,500 – from their original winners at steep discounts. Then they claim the face value of the prizes when they present the tickets at lottery payment centers in Wilsonville and Salem.

As detailed in an investigation published last summer by The Oregonian/Oregon Live, the scheme enables tax evasion. It allows some winners to avoid past due child support and other debts to the state that would otherwise be garnished from their prizes. It can incentivize sketchy operators to manipulate winners into selling tickets. And in some states, it has been linked to money laundering.

Oregonians looking to renew their vehicle registration and get new tags can now do so at a handful of Fred Meyer stores around the state

The self-service express kiosks from Oregon Driver and Motor Vehicle Services are designed to give Oregonians another way to renew their registration besides at a DMV office, online or by mail, according to a news release.

The kiosks are located in Fred Meyer locations in Salem and Eugene as well as in Beaverton, Bend, Happy Valley, Hillsboro, Medford, Oak Grove and Tualatin. A location in Portland is coming soon and the DMV said it plans to offer more kiosks around the state in the future.

In Salem, the kiosk is at the Fred Meyer located at 3740 Market St. NE and allows users to pay by cash, credit or debit card. In Eugene, it’s located at the Fred Meyer at 3333 W 11th Ave. and will only allow payment via debit or credit card.

“We see these kiosks as a way to improve customer service, access and equity,” DMV administrator Amy Joyce said in the news release. “This program is the latest effort aimed at improving the DMV experience for our customers.”

The kiosks are ADA-accessible and registration renewal can be completed in English and Spanish. Users will be charged a $4.95 vendor fee for each transaction.

Customers will need to bring identification (license, permit, or ID card), insurance information and registration renewal notice. — Vehicle registration cards and license plate stickers will be printed after the transaction.

Registration Is Now Open For The Bob Ross-inspired Happy Little (Virtual) 5K Run for the Trees

Oregon Parks Forever — Inspired by American painter and PBS television personality Bob Ross’ love of the outdoors, Oregon Parks Forever is sponsoring a virtual 5K race to help plant trees in Oregon’s parks & forests. Registration is now open for the 2025 Run for the Trees at www.orparksforever.org.

Participants can run, walk, hike, skate, paddle or roll to complete their 5K anywhere outdoors anytime between April 19 and 27 (covering Earth Day and Arbor Day). Participants are encouraged to register by April 1 to ensure that your swag arrives before the event week. If you register after April 1, you may not receive your swag before race week. Registration will close on April 15.

For $36 per person, each participant will receive a keepsake Happy Little T-shirt, a commemorative bib number and a finisher’s medal. All Oregon race proceeds support tree planting and forest protection efforts in Oregon parks. Ten trees will be planted in Oregon for each registration.

Gather your friends, family and/or colleagues and create your own walk or run. Make it fun!

Initially, the “Happy Little Trees” program began with a partnership between the Michigan Department of Natural Resources and Bob Ross Inc., with hundreds of volunteers helping to plant “happy little trees” at locations hard-hit by invasive pests and tree diseases. The partnership quickly expanded to include the Run for the Trees / Happy Little (Virtual) 5K.

As the Happy Little 5K gained popularity, more states have joined the effort. Now in its fifth year, the Happy Little 5K has expanded its reach to include ten other states. Together, Michigan, Oregon, Florida, Georgia, Indiana, Ohio, Pennsylvania, South Carolina, Wisconsin, Maryland and Virginia will “lock arms” as they help raise awareness and funding for stewardship efforts in each state’s parks.

“We are thrilled to partner with Bob Ross, Inc. and these other ten states on the Happy Little 5K concept as a way to honor the late Bob Ross and create a legacy event to plant trees,” said Seth Miller, Executive Director of Oregon Parks Forever.”

Oregon Parks Forever joined this event as an expansion of our efforts to fund the replanting of trees killed by wildfires, heat domes and invasive insects. Over the past three years, Oregon Parks Forever has been able to fund the replanting of more than 800,000 trees across Oregon.

“The official Bob Ross 5K is probably our most favorite initiative,” says Joan Kowalski, president of Bob Ross Company. “It’s the perfect blend of everything Bob held dear; nature, taking care of the environment, and happy trees too of course. He would have been so pleased to see how it’s getting so popular around the world.” — Learn more about the program at http://www.orparksforever.org

IRS Direct File, Direct File Oregon Will Be Available When Income Tax Return Processing Begins January 27

Salem, OR— Free electronic filing through the combination of IRS Direct File and Direct File Oregon will open January 27 when both the IRS and the Oregon Department of Revenue begin processing e-filed 2024 federal and state income tax returns. Paper-filed return processing will begin in mid-February.

Taxpayers are encouraged to use the IRS Eligibility Checker to see if they qualify to file directly with the IRS and the state.

E-filed returns will be processed in the order they are received. However, as in years past, the department won’t be issuing personal income tax refunds until after February 15. A refund hold is part of the department’s tax fraud prevention efforts and allows for confirmation that the amounts claimed on tax returns match what employers and payers report on Forms W-2 and 1099.

E-filing is the fastest way for a taxpayer to get their refund. On average, taxpayers who e-file their returns and request their refund via direct deposit receive their refund two weeks sooner than those who file paper returns and request paper refund checks.

The department reminds taxpayers that taking a few easy steps in the next few weeks can make preparing their 2024 tax return easier in 2025.

Free filing options open January 27 — In addition to IRS Direct File and Direct File Oregon, other free filing options will also open January 27. Free guided tax preparation is available from several companies for taxpayers that meet income requirements. Free fillable forms are available for all income levels. Using links from the department’s website ensures that both taxpayers’ federal and state return will be filed for free.

Free and low-cost tax help — Free tax preparation services are available for low- to moderate-income taxpayers through AARP and CASH Oregon. United Way also offers free tax help through their MyFreeTaxes program. Visit the Department of Revenue website to take advantage of the software and free offers and get more information about free tax preparation services.

Voluntary self-identification of race and ethnicity information — New for 2025, Oregon taxpayers and Oregonians can voluntarily provide information about their race and ethnicity on Form OR-VSI when they file their 2024 taxes. Providing this information may be done separately from a tax return through Revenue Online. The information will be confidential. It can only be used for research purposes to analyze potential inequities in tax policy. The new option is a result of Senate Bill 1 in 2023.

Use Revenue Online to verify payments — Taxpayers can verify their estimated payments through their Revenue Online account.

Through Revenue Online, individuals can also view letters sent to them by the department, initiate appeals, make payments, and submit questions. Visit Revenue Online on the Revenue website to learn more.

Those who don’t have a Revenue Online account can sign up on the agency’s website.

To check the status of their refund after February 15, or make payments, taxpayers can visit Revenue’s website. You can also call 800-356-4222 toll-free from an Oregon prefix (English or Spanish) or 503-378-4988 in Salem and outside Oregon. For TTY (hearing or speech impaired), we accept all relay calls.

Department Of Revenue Volunteers Will Help Taxpayers Use Direct File Oregon To E-file Their Taxes For Free At Libraries Across The State

Salem, OR—Oregonians looking for assistance in electronically filing their taxes for free, could find help as close as their local library this tax season.

Volunteers from the Oregon Department of Revenue will be traveling to libraries in 17 different communities across the state in February, March, and April to assist taxpayers in using the free combination of IRS Direct File and Direct File Oregon to complete their returns.

The one-day tax help clinics are planned at libraries in:

| Bandon | North Bend |

| Burns | Prineville |

| Coquille | Pendleton |

| Cornelius | Roseburg |

| The Dalles | Salem |

| Klamath Falls | Seaside |

| Lebanon | Sweet Home |

| McMinnville | Toledo |

| Tualatin |

Dates, times, and addresses for each clinic can be found on the Free Direct File assistance at local libraries webpage.

Last year, more than 140,000 taxpayers in 12 other states filed their federal tax returns using a limited IRS Direct File pilot program while nearly 7,000 Oregon taxpayers filed their state returns using the free, state-only Direct File Oregon option.

The U.S. Department of the Treasury announced in May that it would make IRS Direct File a permanent option for taxpayers and invited all 50 states to participate. Oregon was the first of 13 new states to accept the invitation from the IRS in June creating a seamless free e-filing system for both federal and state taxes.

With the two direct file systems connected, the IRS estimates that 640,000 Oregon taxpayers will be able to e-file both their federal and state returns for free in 2025.

The department believes that offering free assistance will help maximize the number of Oregonians who choose to use the new free option and make it possible for many who don’t have a filing requirement to file and claim significant federal and state tax credits for low-income families.

For example, the IRS estimates that one in five Oregon taxpayers eligible to claim the federal Earned Income Tax Credit are not doing so. One Oregon organization estimates that the unclaimed credits have totaled nearly $100 million in recent years.

Taxpayers should use the IRS eligibility checker to see if they’ll be able to use IRS Direct File and Direct File Oregon. Eligible taxpayers should set up an IRS online account and an account with Oregon’s Revenue Online before they come to an event. Taxpayers attending an event should bring the following information with them.

- Social security card or ITIN for everyone on your tax return

- Government picture ID for taxpayer and spouse if filing jointly (such as driver’s license or passport)

Common income and tax documents

- Forms W2 (wages from a job)

- Forms 1099 (other kinds of income)

- Form SSA-1099 (Social Security Benefits)

Optional documents to download

- Canceled check or bank routing and account numbers for direct deposit

- Last year’s tax return

Taxpayers can signup for the new “Oregon Tax Tips” direct email newsletter to keep up with information about tax return filing and how to claim helpful tax credits.

AARP Foundation Tax-Aide Sites Open in Oregon: Program Provides Free Tax Prep to Thousands of Older Adults

AARP Foundation Tax-Aide is providing free preparation now through April 15 throughout Oregon. Started in 1968, Tax-Aide is the nation’s largest free, volunteer-based tax assistance and preparation program and has served more than 80 million people. For the 2024 tax season, nearly 28,000 volunteers helped almost 1.7 million taxpayers, 965,000 of whom were adults over 50 with low income. Tax-Aide is offered in conjunction with the IRS, and AARP membership is not required.

“During the 2024 tax season, AARP Foundation Tax-Aide volunteers completed over 19,400 federal returns and 18,500 state returns in Oregon with refunds of nearly $39 million,” said AARP Oregon State Director Bandana Shrestha. “Even modest refunds can make an impact on financial resilience, especially for vulnerable older adults. AARP Foundation Tax-Aide helps put money back in the pockets of Oregonians every year by making sure they don’t miss out on the credits and deductions they have earned.”

Tax-Aide volunteers provide free tax preparation and filing services to all with a focus on adults with low to moderate income. Volunteers are trained and IRS-certified every year to ensure they understand the latest changes to the U.S. Tax Code.

AARP Foundation Tax-Aide offers a variety of options to better meet the needs of taxpayers. Access to the different types of assistance varies by location.

- In-Person Service: Tax preparation is completed by an IRS-certified Tax-Aide volunteer on-site in one visit.

- One-Visit Scan: Tax documents are scanned at the Tax-Aide site and then Tax-Aide volunteers prepare the return remotely.

- Two-Visit Scan: Tax documents are scanned at the Tax-Aide site and then volunteers prepare the return remotely. During a second visit, taxpayers work with a volunteer to finalize their return and obtain a printed copy for their records.

- Drop-Off Service: Tax documents are left at the Tax-Aide site with a volunteer and the return is prepared remotely. During a second visit, taxpayers work with a volunteer to file their return and obtain a printed copy and their original documents.

- No Site Visit Required (Internet Access Required): Taxpayers upload tax documents to the IRS-provided software. Tax-Aide volunteers prepare the return remotely and work with the taxpayer to file the return electronically.

- Online Coaching: Taxpayers prepare their own return and receive online support from a volunteer to help them along the way.

- Facilitated Self-Assistance: Taxpayers schedule an appointment at a Tax-Aide site to work with a volunteer to complete and file their own return.

- Self-Preparation: Taxpayers prepare their own return using a software product that has been made available through the Tax-Aide website.

Users can find their nearest Tax-Aide location and assistance options through the Tax-Aide site locator. The site locator features a Tax-Aide chat bot that can help book an appointment, answer questions about the program, and transfer the conversation to a live agent if needed or requested. For more information, including which documents to bring to the tax site, visit aarpfoundation.org/taxaide or call 1-888-AARPNOW (1-888-227-7669)

https://www.facebook.com/groups/1109674113319848

Call us at 541-690-8806. Or email us at Info@RogueValleyMagazine.com