The latest news stories of interest in the Rogue Valley and the state of Oregon from the digital home of Southern Oregon, Wynne Broadcasting’s RogueValleyMagazine.com

Friday, February 7, 2025

Rogue Valley Weather

https://graphical.weather.gov/sectors/oregon.php

US National Weather Service Medford Oregon

Pacific Power restoration efforts near completion — Heavy snow and hazards continue to impede efforts

Pacific Power crew make repairs near Medford

Pacific Power crews are in the final stages of restoring power to impacted customers in southern Oregon. Most customers should have service restored by 10 p.m.

Nearly 80,000 customers lost power at some point during the winter weather event, which brought heavy, wet snow to the impacted areas.

More than 300 field crews and other personnel are involved in restoration efforts, working around the clock to make repairs. In the Medford, Grants Pass and Klamath Falls districts, field crews are responding to more than 200 spans of downed power lines, as well as broken poles and other damaged electrical equipment.

In some areas, repair teams have had to work in three feet of snow, with downed trees blocking roads. Access continues to be an issue in some areas, which require repair crews to hike in on foot.

“Our crews have been working tirelessly in extremely challenging conditions to get the lights back on for our customers,” said Tom Eide, Pacific Power’s vice president of operations. “We thank our customers for their patience and understanding as we continue to repair and restore their service.”

Visit pacificpower.net/outages for a map showing current restoration estimates.

Pacific Power encourages customers to report outages by calling 1-877-508-5088 or text OUT to 722797. Text STAT to 722797 to check the status of your outage.

Customers with safety concerns should call 2-1-1 to connect with local service providers.

Strong Winter Storm Still Impacting Southern Oregon

Here are updated snowfall amounts and probabilities. Valley floor accumulation is going to be hard if temperatures don’t lower. A lot of uncertainty at the lower elevations (around 2000 feet and lower) for accumulation, but moderate confidence exists for elevations of 2500-4000, with high confidence in accumulations for 4000+ feet. We hope everyone stays safe and warm!

A strong winter storm brought heavy snowfall and freezing temperatures to parts of southern Oregon and northern California. Many areas still impacted.

PUBLIC SAFETY ANNOUNCEMENT From the Jackson County Sheriff’s OfficeEffective Immediately – Winter Weather Advisory Issued: February 4, 2025 The Jackson County Sheriff’s Office is issuing a Public Safety Announcement due to moderate snowfall and overnight sub-freezing temperatures expected for the next two days. These conditions will create hazardous roadways and significantly impact travel. The winter storm has placed an extraordinary burden on our deputies, who are diligently responding to both weather-related crises and their standard calls for service.

According to the National Weather Service (NWS) Medford, areas under a Winter Storm Warning—including the Kalmiopsis Wilderness and the Marble and Siskiyou Mountains—can expect 3 to 8 inches of snow, with higher elevations receiving up to 16 inches.

A Winter Weather Advisory is in effect for the Rogue and Illinois Valleys, where 2 to 5 inches of snow is expected. Crater Lake and the eastern Douglas County foothills may see up to 12 inches by Thursday morning. Meanwhile, a Flood Warning remains for the Pit River due to snowmelt.

Drivers should be cautious as freezing temperatures overnight will create icy road conditions, especially on bridges and overpasses.

S𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗮𝗹 𝗖𝗼𝗹𝗹𝗮𝗽𝘀𝗲 𝗥𝗲𝘀𝗰𝘂𝗲

2025 Josephine County Search & Rescue Academy

DETAILS: The Josephine County Sheriff’s Office Search & Rescue Division will be hosting its annual Academy to train new SAR volunteers. The academy, held at 250 Tech Way, Grants Pass, OR, covers Basic Survival Skills, First Aid/CPR, Land Navigation, and more. Completion qualifies attendees as SAR volunteers.

Cost: $55. Additional requirements include a background check, criminal history check, and personal equipment purchase.

The Academy runs Tuesday and Thursday evenings (6-9 PM), Saturdays (8 AM-5 PM) from February 18 to March 15. For registration and details, visit: https://bit.ly/4hjCVDU

Application deadline: February 17, 2025.

City of Grants Pass, Local Government — Job Opportunity: Police Officer

The Britt Festival Orchestra (BFO) announces its 2025 season, with three weeks of exciting outdoor programming in historic Jacksonville, Oregon, June 12 – 28, 2025.

Under the leadership of four guest conductors, Damon Gupton (June 12-13); Chia-Hsuan Lin (June 15-18); Roberto Kalb (June 21-23); and Normal Huynh (June 26-28) the Orchestra’s 63rd season highlights a feature film alongside beloved classical favorites.

The season features seven extraordinary guest artists: pianist Clayton Stephenson performing Ravel’s Concerto in G Major; violinist William Hagen performing Korngold’s Concerto in D Major; violinist Tessa Lark and cellist Wei Yu performing Brahms Double concerto for Violin & Violoncello in A minor; vocalist Sun-Ly Pierce performing Ravel’s Shéhérazade; pianist Jaeden Izik-Dzurko performing Rachmaninoff’s Concerto No. 3 in D minor; and violinist Simone Porter performing Stravinsky’s Violin Concerto in D and Ravel’s Tzigane. The season will begin with two evenings of Jurassic Park in Concert whereJohn Williams’ score will be performed live-to-picture by the full orchestra in one of the most beloved films of the 20th Century.

Britt Music & Arts Festival shares extraordinary live performances and arts education experiences that inspire discovery and build community, anchored at the Britt hill amphitheater. Since its grassroots beginnings in 1963, the non-profit organization has grown from a two-week chamber music festival to a summer-long series of concerts in a variety of genres, including a three-week orchestra season, and year-round education and engagement programs. For more information, visit www.brittfest.org

The Jackson County Expo announced its 2025 summer concert lineup taking the stage during the Jackson County Fair in July.

According to the Expo, musical acts including Outlaw Mariachi, Jo Dee Messina, and a Taylor Swift tribute will take the stage in Central Point this summer.

The Jackson County Fair runs from July 15 through July 20. Fair tickets start at $12 and include lawn seats at the Bi-Mart Amphitheater.

Concert ticket prices start at $25 and go on sale to the public on Tuesday. Fair admission is included with the purchase of a reserved seat.

Full 2025 Jackson County Fair Concert lineup:

Tuesday, July 15 – Outlaw Mariachi

Wednesday, July 16 – Jo Dee Messina

Thursday, July 17 – Kansas

Friday, July 18 – Skillet

Saturday, July 19 – Are You Ready For It? A Taylor Experience

For more information or to purchase a ticket, visit the Jackson County Expo’s website: https://attheexpo.com/fair/

Upper Rogue River Users, Look for New Signs for Boat Operations

The Oregon State Marine Board passed new rules for boat operations on the Upper Rogue River during its quarterly January 23rd Board meeting. The rules go into effect on February 1, 2025.

Temporary signs will be installed by January 31 at the following boating access sites:

- Fishers Ferry County Park

- TouVelle State Park

- Dodge Bridge County Park

- Takelma County Park

- Upper Rogue Regional County Park

- Rogue Elk County Park

- Casey County Park

- McGregor Park Boat Ramp

Permanent signs with graphics outlining specific rule segments on the river are in development and will replace the temporary signs by the spring.

The Marine Board will ramp up education and outreach efforts during the first year of rule implementation.

To stay up to date on the agency’s outreach, follow Boat Oregon on social media (Facebook, Instagram), or subscribe to Boat Oregon News and learn more about the rules from the agency’s Public Meetings page.

Oregon Housing And Community Services Awards Funding To Jackson County Wildfire Survivor To Buy A New Home

Oregon Housing and Community Services

First recovery grant from the Homeowner Assistance and Reconstruction Program

— A Jackson County wildfire survivor is in a new home after becoming the first homeowner to receive funding from the ReOregon Homeowner Assistance and Reconstruction Program (HARP). The program’s funding comes from the federal $422 million Community Development Block Grant Disaster Recovery to help Oregonians and communities recover from the 2020 Labor Day Disasters.

The new three-bedroom, two-bath manufactured home is a chance to start fresh and get back a sense of normalcy. “I can finally breathe again,” said Joan, which is not the homeowner’s real name as they did not want to be identified. “I’m safe. I’m secure… It’s hard to explain, but I finally feel like I can hit the un-pause button. I can finally begin where I left off.”

HARP, a federally funded program launched in 2024, provides qualified homeowners whose properties were damaged by the wildfires and straight-line winds in fall 2020 with financial assistance to repair, rebuild, or replace their homes. This homeowner chose the Home Purchase Pathway, which allows eligible survivors to buy a stick-built or manufactured home that is already installed.

“This is exactly what these funds were meant to do,” said Shannon Marheine, director of Disaster Recovery and Resilience at Oregon Housing and Community Services (OHCS). “Although we know it’s taken longer than anyone hoped, this is just the first of many recoveries that will come from all of the hard work that OHCS, our partners, and the survivors themselves have put in over the years.”

OHCS has received hundreds of HARP applications for assistance from every county affected by the disasters, and staff continue to review them for eligibility.

“There were so many friendly and supportive people from start to finish with the HARP application,” Joan said. “The professionalism and communication were appreciated and supportive. They were always in touch and leading me to the next step.”

To read more about Joan’s story, visit https://apps.oregon.gov/oregon-newsroom/OR/OHCS/Posts/Post/A-wildfire-survivor-story-of-loss-support-and-recovery-in-her-own-words.

OHCS encourages survivors of the 2020 Labor Day Disasters, who have not yet applied, to fill out an eligibility questionnaire at https://www.oregon.gov/ohcs/disaster-recovery/reoregon/harp/Pages/harp-eligibility-questionnaire.aspx.

To learn more about HARP and other ReOregon programs, visit re.oregon.gov, sign up to receive e-mail notifications, or contact the Call Center at 877-510-6800 or 541-250-0938.

About Oregon Housing and Community Services (OHCS)

OHCS is Oregon’s housing finance agency. The state agency provides financial and program support to create and preserve opportunities for quality, affordable housing for Oregonians of low and moderate income. OHCS administers programs that provide housing stabilization. OHCS delivers these programs primarily through grants, contracts, and loan agreements with local partners and community-based providers. For more information, please visit: oregon.gov/ohcs.

The Southern Oregon Chinese Cultural Association has organized a spectacular celebration for Chinese New Year 2025

The celebration will take place at several venues, including Jacksonville’s New City Hall, Community Center, Library, and the Miners’ Bazaar. This multi-venue event aims to make the celebration accessible and engaging for people of all ages. Whether you are familiar with Chinese customs or experiencing them for the first time, there will be something for everyone to enjoy.

While Chinese New Year celebrations are widespread in major cities like San Francisco and New York, Southern Oregon’s observance is unique in its own right. The Southern Oregon Chinese Cultural Association, founded to preserve and promote Chinese culture in the region, has been hosting such events for many years, providing a rare opportunity for local communities to learn about and celebrate Chinese heritage. The celebration in Jacksonville is an example of how this tradition has blossomed in a small town, thanks to the efforts of cultural preservationists and the local Chinese-American community.

Sheriff’s Office issues advisory about motorhome and possible link to missing Prospect woman Deenah Padgett

The Jackson County Sheriff’s Office (JCSO) is asking for help identifying the owner a motorhome. It could be associated with a missing person from the Prospect area.

JCSO says 68-year-old Deenah Padgett has been missing since August 30 from Prospect, described as a white woman, 4’ 8” tall, weighing approximately 95 pounds with brownish red/greying hair.

JCSO issued an advisory this weekend asking anyone with information about the owner of the pictured motor home or Padgett’s whereabouts to call Emergency Communications of Southern Oregon (ECSO) dispatch non-emergency phone number at 541-776-7206.

Did you get help from FEMA, insurance, or others after the 2020 Almeda and South Obenchain Fires?

Hearts with a Mission, a program to help local seniors who need assistance, is seeking volunteers.

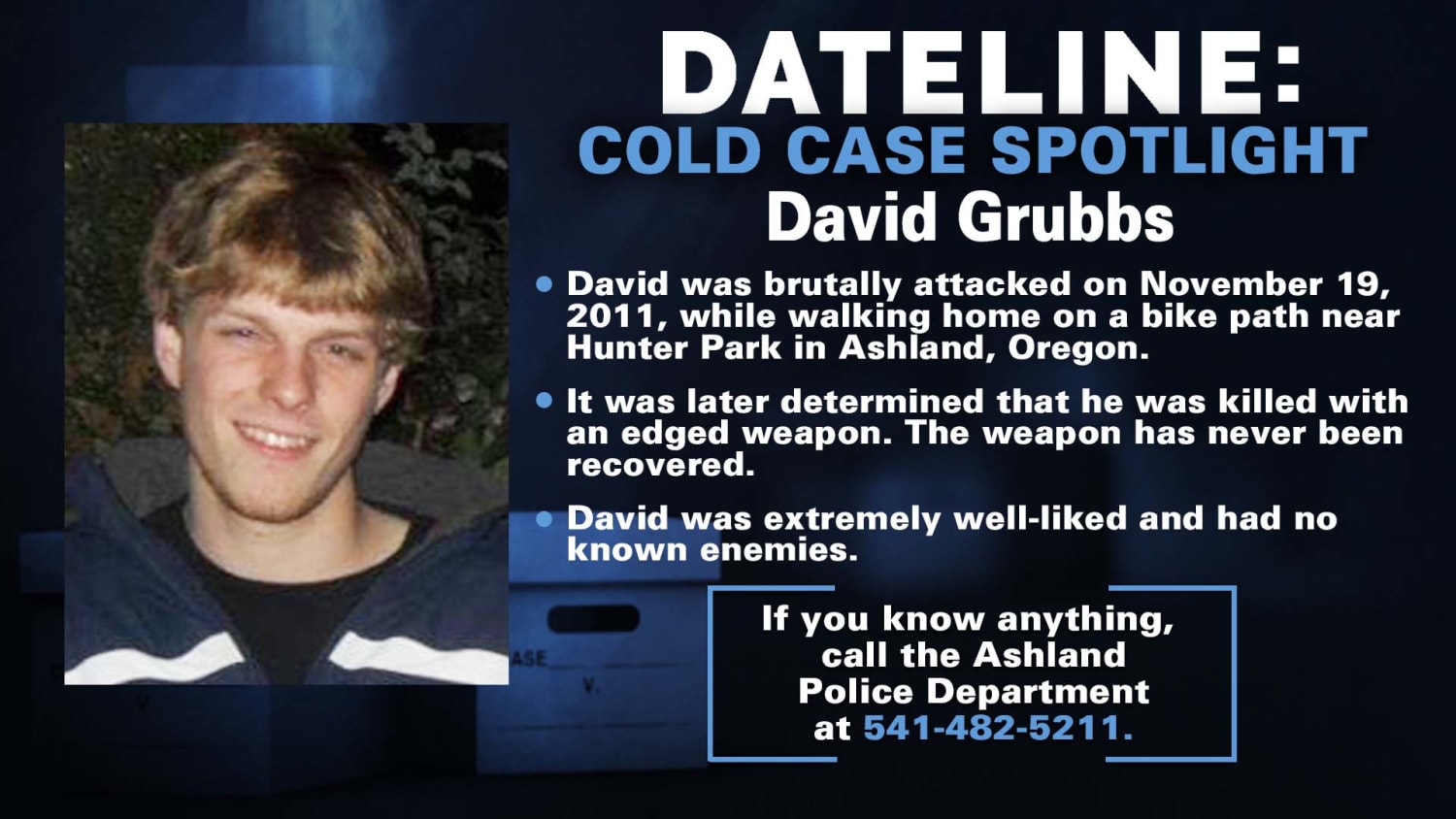

David Grubbs’ Murder Investigation Remains Active

The Ashland Police Department’s investigation into the murder of David Grubbs on November 19, 2011 remains open and active. Recently two new detectives have been assigned to look into new leads that have come in.

The Ashland Police Department’s investigation into the murder of David Grubbs on November 19, 2011 remains open and active. Recently two new detectives have been assigned to look into new leads that have come in.

It’s going on five years now since Fauna Frey, 45, disappeared in Josephine County on a road trip, June 29, 2020, following her brother’s death

PART 2 – Newsweek Podcast Focusing on The Disappearance of Fauna Frey From Lane County

Here One Minute, Gone the Next —– PART 2 – Josephine County Sheriff Dave Daniel joins investigative journalist Alex Rogue to speak with Here One Minute, Gone the Next about the disappearance of Fauna Frey, the growing friction between citizen investigators and law enforcement, and the lack of resources in missing persons cases. https://podcasts.apple.com/us/podcast/the-disappearance-of-fauna-frey-pt2-feat-sheriff/id1707094441?i=1000630100040 PART 1 – John Frey joins Newsweek to discuss exclusive details about the case of his missing daughter that until now have been unavailable to the general public. READ MORE HERE: https://www.newsweek.com/exclusive-what-happened-fauna-frey-new-clues-uncovered-1827197?fbclid=IwAR3Z3Glru5lIgqiYXbs_nA1Fj8JuCIzM11OHSVHfwIucfq2f_G5y9y5bnmQ If you have any information on the whereabouts of Fauna Frey, call the anonymous tip line at 541-539-5638 or email FindFaunaFrey@gmail.com. —- Help Find Fauna Frey #FindFaunaFrey FACEBOOK GROUP

How Healthy Are Oregonians’ Finances? Annual Scorecard Shows Households Are Earning More, Yet Many Families Are Still Struggling To Save And Make Ends MeetSurvey found that roughly half of Oregonians don’t have $500 to cover unexpected expenses

Median income has risen, the impact of inflation has slackened, and more Oregonians are saving for retirement and college, according to the 2025 Oregon Financial Wellness Scorecard, released today by the Oregon State Treasury.

However, the data also show that many Oregonians are in a precarious financial position, and are ill-equipped to weather even a modest economic shock:

- A majority of families say it’s difficult make ends meet each month, especially families with children at home;

- Almost half of Oregonians are so financially fragile that they do not have $500 saved to cover an unexpected expense; And

- More than a third of households can’t afford to save at all, after bills are paid each month – and the frequency of saving declined markedly in households with children where income was less than $75,000

Those are some of the more than 40 takeaways from the annual scorecard, which assembles data from state and federal sources including a statewide survey to help policymakers and the public better understand how pocketbook and economic factors affect Oregonians’ quality of life.

The new summary – which shows both positive and concerning trendlines — is compiled by the Oregon State Treasury in partnership with the Oregon Financial Empowerment Advisory Team, a public-private partnership for which State Treasurer Elizabeth Steiner serves as chair.

“The latest financial snapshot shows that Oregonians work hard, which is leading to higher incomes for many people,” said State Treasurer Steiner. “Innovative Oregon State Treasury programs such as OregonSaves are helping more people set aside money for retirement. But too many people and families barely get by each month. At Treasury, we’ll continue to promote financial empowerment and explore new tools to help Oregon families get ahead and thrive financially.”

Among the positive data points: More Oregonians were medically insured in 2023, and the latest data on retirement saving from the U.S. Census showed that more Oregon households were saving in 2022, and at a frequency higher than the national average.

Also, notably, Oregon household borrowing dipped slightly overall in 2023, according to data from the Federal Reserve.

Financial fragility — which describes the ability of people to handle an economic emergency — was substantially worse for women, for those with a high school education or less, and for families with children at home.

Overall, about half of Oregon households (49%) could not cover an emergency costing $500 or more from savings.

The Scorecard statistics are benchmarked to national figures. Several data categories are also broken down by demographics, by county, or by rural versus urban areas, helping to show that Oregonians experience financial challenges differently.

For instance, in rural counties homeownership rates are higher and so is the percentage of households who rely on public assistance. Some figures are also broken down by age, race, level of education and household income.

Convened to help guide efforts to improve financial wellness statewide, the Oregon Financial Empowerment Advisory Team brings together citizens, representatives of the financial sector, and liaisons from key state agencies that focus on financial education and consumer protection. Quarterly meetings are open to the public.

The advisory team also connects the public to financial resources in partnership with Oregon’s 211info network, and recognizes standout educators and champions annually with the Oregon Financial Empowerment Awards. Nominations are being accepted until March 1.

The Treasury Financial Empowerment Initiative helps inform the work of the Oregon Treasury Savings Network, which administers savings programs to help Oregonians to build long term financial security. Those are the Oregon College Savings Plan, for higher education and career training; Oregon ABLE Savings Plan, for disability-connected costs; and OregonSaves, which allows people to save for retirement if they don’t have a plan at work. (SOURCE)

Oregon congresswoman introduces ‘Stop Musk Act’ as state responds to federal chaos

Rep. Maxine Dexter’s bill would ban retaliation against federal employees who stand up to Elon Musk

New Oregon U.S. Rep. Maxine Dexter didn’t anticipate that the first bill she introduced in Congress would be to prohibit unelected billionaire Elon Musk from retaliating against federal employees.

The pulmonary and critical care doctor ran for Congress to work on lowering prescription drug prices and expand access to behavioral health treatment, as well as addressing other issues she sees working with patients. But constituents in her east Portland district demanded action after Musk and people working for him seized control of federal administrative offices, gained access to the U.S. Treasury Department’s records of Americans’ personal financial information and dismantled the federal agency that distributes aid overseas.

In response, Dexter introduced the “Stop Musk Act,” her first bill. It’s just 43 words, spelling out that no federal employee can face retaliation for “resisting, circumventing or preventing Elon Musk or individuals he oversees from taking unlawful or unconstitutional actions relating to federal agencies.”

“It’s not what I had on my bingo card, but it’s definitely what is needed right now,” Dexter said. “And it’s absolutely in response to my constituents. Over 1,000 of them have called and specifically talked about Elon Musk needing to be stopped this week.”

Dexter’s proposal, which she acknowledged has next to no chance of passing in the Republican-controlled House, is among several actions Oregon’s Democratic congressional delegation have taken to oppose the Trump administration and Musk’s unprecedented power over federal agencies.

U.S. Rep. Janelle Bynum, a swing-district Democrat who like Dexter is in her first term, joined Oregon’s Sens. Ron Wyden and Jeff Merkley at a rally outside the U.S. Treasury on Tuesday. She directed most of her comments toward Musk.

“Get your hands out my pockets!” she said. “Get your foot off the Constitution. Take your foot off my neck.”

Over the weekend, U.S. Reps. Val Hoyle and Andrea Salinas joined Merkley for town hall events in Newport, Philomath and Salem where they told crowds of hundreds that they were ready to fight. Dexter is planning more town halls and hopes to have Attorney General Dan Rayfield join her at one. Rayfield, who served with Dexter in the state House, is leading Oregon’s legal response to the Trump administration, including securing an indefinite block Thursday to a Trump executive order that attempted to repeal a constitutional guarantee that babies born in the U.S. to immigrant parents are automatically citizens, even if their parents are not. (SOURCE)

House Democrat leaves congressional DOGE caucus, saying Musk is ‘blowing things up’

Democratic Oregon House member says ‘it is impossible to fix the system when Elon Musk is actively breaking it’

Rep. Val Hoyle, D-Ore., said on Thursday that she is leaving the congressional Department of Government Efficiency (DOGE) Caucus due to Elon Musk’s cost-cutting measures in the executive branch.

Hoyle made the announcement via a statement and said her intentions on the caucus were to serve as a good steward for her constituents’ tax dollars and to make the government more streamlined and efficient.

However, she said Musk’s actions, which are separate from the congressional caucus, have made that impossible, and she claimed DOGE’s work is to find funds to give tax breaks to billionaires at the expense of working people.

“It is impossible for us to do that important work when unelected billionaire Elon Musk and his lackeys [insist] on burning down the government—and the law—to line his own pockets and rip off Americans across the country who depend on government services to live with dignity,” she wrote in an accompanying statement.

The newly minted agency, a key promise of President Donald Trump‘s re-election campaign, is tasked with slashing government waste and providing increased transparency when it comes to government spending. It was created via executive order and is a temporary organization within the White House that will spend 18 months until July 4, 2026, carrying out its mission.

Hoyle said she was alarmed about Musk’s team accessing sensitive Department of Treasury payment systems. She also accused his team of using intimidation tactics to “terrorize the hard-working public servants” who deliver these services. (SOURCE)

Oregon Nurses Association Reaches Tentative Agreement with Providence Oregon Following Intensive Mediation

– After seven days of intensive mediation, initiated at the request of Oregon Governor Tina Kotek, and after 26 days on strike (and counting), the Oregon Nurses Association (ONA) today reached a tentative agreement with Providence Oregon at the 8 registered nurse (RN) bargaining units currently on strike.

Those units include Providence St. Vincent, Providence Portland Medical Center, Providence Medford Medical Center, Providence Newberg, Providence Willamette Falls, Providence Milwaukie, Providence Hood River and Providence Seaside. (The hospitalists at St. Vincent Medical Center remain on strike and in negotiations.)

Broadly speaking, key provisions of the agreement include:

- Annual Step Increases & New Step 30: In 2026, nurses will receive annual step increases with a new Step 30 and additional fill-in steps added across all bargaining units.

- Wage Increases: Across-the-board increases over the life of the contract and increases for members upon ratification.

- Ratification Bonus: We were not able to achieve full retroactive pay. Instead, a portion of retro pay will be distributed as a bonus based on hours worked since contract expiration.

- No Changes to Contract Expiration Dates: We were not able to achieve contract alignments. Current contract expiration dates will remain unchanged across all Providence Oregon facilities.

- Break & Meal Penalty Pay: Nurses will automatically receive one hour of penalty pay for each missed break or lunch.

- Statewide Health Benefits Workgroup: A workgroup will be established to evaluate and make recommendations on health benefits and the feasibility of a statewide health benefits trust.

- Aetna Health Care Customer Service: A dedicated Aetna customer service team will be available for members to assist in navigating changes to employer-provided health insurance.

- Staffing: Contract language memorializing Oregon’s new staffing law and other hospital-specific benefits.

Ratification votes will open on Thursday, February 6 at 8 a.m. and close on Friday, February 7 at 4 p.m. (Note: Due to inclement weather, ratification vote times for Providence Medford will be Thursday, February 6 from 8 a.m. and closing Saturday, February 8 at 4 p.m.)

Nurses will remain on strike during the vote and will return to work if tentative agreements are ratified.

Note: ONA will not provide further comment until after the vote closes. The Oregon Nurses Association (ONA) Represents A Diverse Community Of More Than 21,000 Nurses, And Health Care Professionals Throughout Oregon. Together, We Use Our Collective Power To Advocate For Critical Issues Impacting Patients, Nurses, And Health Care Professionals Including A More Effective, Affordable And Accessible Healthcare System; Better Working Conditions For All Health Care Professionals; And Healthier Communities. For More Information Visit Www.OregonRN.org.

Statewide harm reduction program gets $5.1 million from Opioid Settlement Board

PORTLAND, Ore. — The Opioid Settlement Prevention, Treatment & Recovery Board (Board) is directing $5.1 million toward the Save Lives Oregon harm reduction clearinghouse at Oregon Health Authority. This investment serves to continue the Board’s commitment to fill gaps across the substance use disorder continuum of care.

The Board recognized the importance of distributing life-saving overdose reversal medications, but also that more work remains to provide needed services to people seeking support and services for substance use disorder and overdose prevention.

The allocation represents 22% of the Board’s total allocation budget of $23.4 million for the 2025-27 fiscal biennium that begins July 1. Programs focused on primary prevention, treatment and recovery will receive similar percentages.

The Board also provided an additional $237,000 toward a previously approved recommendation of $830,000 for the expansion of culturally specific services in existing recovery community centers throughout the state, bringing the total allocation to more than $1 million for the current fiscal biennium.

The funding was awarded to OHA, which will administer the allocations. The Board’s decision can be viewed in a recording of its Feb. 5 meeting.

We are confident that this investment will indeed save lives in Oregon by expanding our statewide capacity to provide naloxone and other live-saving services to people most in need,” said Board Co-Chair Annaliese Dolph. “But, in doing so, we recognize that this is not enough, and that additional and sustained investment is urgently needed to stem the tide of substance use disorder and overdose in Oregon. The Board calls on the Legislature to fulfill the Governor’s request for ongoing funding for Save Lives Oregon.”

Since July 2021, the State of Oregon has reached agreement on national lawsuits against several companies for their roles in the opioid crisis. Through these agreements, more than $600 million will be awarded to Oregon through 2039. Settlement funds from opioid manufacturers, distributors and pharmacies are divided between the State of Oregon (45%) and local jurisdictions (55%).

The state’s share is deposited into the Opioid Settlement, Prevention, Treatment and Recovery (OSPTR) Fund as it becomes available. This fund is controlled by the 18-member OSPTR Board.

Throughout the current fiscal biennium ending in June 2025, about $98.5 million will be deposited into the OSPTR Fund. To date, more than $90 million has been allocated.

According to the Opioid Settlement Board’s annual report, published this week, Oregon allocated $74 million of the state portion of opioid settlement funds on locally based initiatives and programs across Oregon in the 2023-24 fiscal year (covering the period from July 1, 2023, through June 20, 2024).

The report showed nearly identical percentages allocated across the continuum of substance use services statewide.

Highlights of the spending this biennium include:

- 30% ($27.7 million) for the Nine Federally Recognized Tribes of Oregon –equivalent to 30% of all funds anticipated this biennium. This 30% set-aside will continue throughout the life of the fund as additional settlement payments are deposited.

- 22% ($13.7 million) for the Save Lives Oregon Harm Reduction Clearinghouse to distribute naloxone and other life-saving supplies to organizations across Oregon.

- 22% ($13.7 million) to support primary prevention programs though counties and community based organizations, and to build up and strengthen the statewide substance use disorder prevention workforce.

- 21% ($13.08 million) to establish recovery community centers in counties with the greatest need and expand youth and culturally specific services in existing recovery community centers.

- 23% ($14.3 million) to add mobile and non-mobile medication units to existing Oregon opioid treatment programs (OTPs), and for Oregon Health & Science University (OHSU) to provide training and technical assistance to jails to improve access to medications for opioid use disorder.

The OSPTR Board will next consider additional investments in research and evaluation.

To learn more about Oregon’s opioid settlement funds, visit oregon.gov/opioidsettlement

Oregon Lottery sends Shari’s restaurants to collections for $900,000 plus interest

The Oregon Lottery has sent Shari’s Cafe and Pies restaurant chain to collections for $900,000, a Lottery spokesperson confirmed Thursday.

In addition, Oregon Lottery Senior Communications Manager Matt Shelby confirmed a report that the Oregon Department of Revenue will tack on 9% interest.

Shari’s closed all its Oregon restaurants, including a handful in Central Oregon, last October after 46 years. Shari’s patrons could play video lottery games at the restaurants, with equipment supplied by the Lottery. Shortly after the closures, a lottery spokesperson told news outlets the following:

“Each week, our retailers deposit money into an account for what’s called our ‘draw’ or the revenue that’s due to us for Video Lottery play,” spokesperson Melanie Mesaros said. “When a retailer fails to pay their weekly electric fund transfer draw and the bank does not pay due to ‘non sufficient funds’ or NSF, they are required to pay us immediately or our equipment will be disabled.” Mesaros said the Lottery learned that Shari’s had an NSF on Oct. 16 and was unable to pay or provide a bond.

OpenAI looks to Oregon, other states for sites to build its Trump-backed Stargate AI data centers

The ChatGPT maker put out a request for proposals for land, electricity, engineers and architects and began visiting locations in Oregon, Pennsylvania and Wisconsin.

OpenAI is scouring the U.S. for sites to build a network of huge data centers to power its artificial intelligence technology, expanding beyond a flagship Texas location and looking across 16 states to accelerate the Stargate project championed by President Donald Trump.

The maker of ChatGPT put out a request for proposals for land, electricity, engineers and architects and began visiting locations in Oregon, Pennsylvania and Wisconsin this week.

Trump touted Stargate, a newly formed joint venture between OpenAI, Oracle and Softbank, shortly after returning to the White House last month.

The partnership said it is investing $100 billion — and eventually up to $500 billion — to build large-scale data centers and the energy generation needed to further AI development. Trump called the project a “resounding declaration of confidence in America’s potential” under his new administration, though the first project in Abilene, Texas, has been under construction for months.

Elon Musk, a Trump adviser and fierce rival of OpenAI who’s in a legal fight with the company and its CEO Sam Altman, has publicly questioned the value of Stargate’s investments.

After Trump’s announcement, a number of states reached out to OpenAI about welcoming additional data centers, Chris Lehane, OpenAI’s vice president of global affairs, told reporters Thursday.

The company’s request for proposals calls for sites with “proximity to necessary infrastructure including power and water.”

AI uses vast amounts of energy, much of which comes from burning fossil fuels, which causes climate change. Data centers also typically draw in large amounts of water for cooling.

OpenAI’s proposal makes no mention of whether it intends to prioritize renewable energy sources such as wind or solar to power the data centers, but it says electricity providers should have a plan to manage carbon emissions and water usage.

“There’s some sites we’re looking at where we want to help be part of the process that brings new power to that site, either from new gas deployment or other means,” said Keith Heyde, who directs OpenAI’s infrastructure strategy.

The first Texas project is in a region Abilene’s mayor has described to The Associated Press as rich in multiple energy sources, including wind, solar and gas. Also describing it that way is the company that began building the AI data center campus there in June — the same two “big, beautiful buildings” that Altman showed off in a recent drone video posted on social media.

Crusoe CEO Chase Lochmiller said that wind power is central to the project his company is building, though it will also have a gas-fired generator for backup power.

“We try to build data centers in locations where we can access low-cost, clean and abundant energy resources,” Lochmiller said. “West Texas really fits that mold where it’s one of the most consistently windy and sunny places in the United States.”

Lochmiller said he expects the Trump administration, despite the president’s opposition to wind farms, to be pragmatic in supporting wind-powered data centers when it is “actually the cheapest way to access energy.”

The other states where OpenAI is actively looking include Arizona, California, Florida, Louisiana, Maryland, Nevada, New York, Ohio, Utah, Virginia, Washington and West Virginia. Heyde said the company only plans to build “somewhere between five to 10” campuses in total, depending on how large each one is.

OpenAI previously relied on business partner Microsoft for its computing needs, but the two companies recently amended their partnership to enable OpenAI to pursue data center development on its own. (SOURCE)

Oregon Check Casher Sentenced to Federal Prison for Payroll Tax Scheme Involving $177 Million

PORTLAND, Ore.–A Tualatin, Oregon man was sentenced to federal prison today for conspiring to defraud the United States and filing false currency transaction reports.

David Katz, 48, was sentenced to 48 months in federal prison and three years’ supervised release. He was also ordered to pay $44,877,254 in restitution to the IRS.

According to court documents and trial testimony, from January 2014 through December 2017, Katz, as president of Check Cash Pacific, Inc., conspired with others in the construction industry to defraud the United States by facilitating under-the-table payments to construction workers. To carry out the scheme, sham construction companies were created and used to cash more than $177 million in payroll checks at different Check Cash Pacific locations. The cash was used to pay construction workers under-the-table, with no taxes being withheld or reported to the IRS.

Construction companies would notify Katz when they planned to bring checks into one of his check cashing locations so that Katz could ensure he had enough cash on hand to complete the transaction. Hundreds of thousands of dollars of payroll checks were cashed daily and Katz was aware that at least one of his co-conspirators used a false name and social security number. Acting as compliance officer, Katz allowed hundreds of false regulatory reports to be filed knowing they contained the fake identity.

For his role in the scheme, Katz received a 2% commission on each transaction which, in total, amounted to more than $4 million. Over the course of their conspiracy, Katz and his co-conspirators prevented the IRS from collecting more than $44 million in payroll and income taxes due on the cash wages.

On December 2, 2021, a federal grand jury in Portland returned a five-count indictment charging Katz with one count of conspiracy to defraud the United States and four counts of filing false currency transaction reports with FinCEN. On June 12, 2024, a federal jury in Portland found Katz guilty of all charges.

This case was investigated by IRS Criminal Investigation. It was prosecuted by Robert S. Trisotto and Andrew T. Ho, Assistant U.S. Attorneys for the District of Oregon.

St. Helens school board fires teacher accused of sexual abuse

Choir teacher Eric Stearns faces 18 charges of sexual abuse. He was put on leave after his first arrest in November but had not been officially fired. — The St. Helens school board has officially fired Eric Stearns, one of two teachers at the center of a sexual abuse scandal that has roiled the district and the town. Stearns was put on administrative leave after being arrested in November, but he wasn’t formally dismissed until a special board meeting Wednesday night.

Stearns posted bail after his first arrest but was arrested again in January on additional charges and was ordered held without bail. He is currently in jail, facing what is now a total of 18 charges of sexual abuse against 12 people. The case was recently delayed after the original judge recused himself in response to a complaint from Stearns’ lawyer.

The scandal began with the arrest of Stearns and retired teacher Mark Collins on Nov. 12 following what police described as a two-month investigation into allegations of “historic sexual abuse” at St. Helens High School.

School principal Dr. Katy Wagner and district superintendent Scot Stockwell were subsequently put on leave and announced to be under investigation for — and in Wagner’s case, charged with — misconduct for failing to report sexual abuse allegations against teachers. A total of 10 staff are now on leave.

The district announced last week that it had named Dr. Karen Fischer Gray as acting superintendent for the remainder of the current school year, following the departure of initial interim superintendent Dr. Steve Webb, who had been hired in November on a three-month contract. Dr. Charlotte Ellis has also been appointed as acting principal at the high school.

The district hired a third-party investigator to look into the scandal in December, and an investigative report was initially set to be released last month but was delayed by a few weeks due to what a district spokesperson described as the investigator identifying a need to conduct additional interviews. (SOURCE)

An Oregon House bill would allow retailers to legally scan ID for people buying tobacco or alcohol, regardless of their age.

The legislation follows a pair of lawsuits challenging the practice, claiming universal ID checks were against existing state law and an invasion of privacy.

In September, KGW reported on the growing number of retailers who implemented universal ID checks for alcohol or tobacco products. Jonathan Polonsky, CEO of Plaid Pantry, said the policy of carding everyone eliminated any guesswork and kept the company in compliance with state and local requirements. Oregon law prohibits the swiping of a driver’s license except under certain circumstances, including the sale of age-restricted products if there is any reasonable doubt that the person is 21. Reasonable doubt exists if the person appears to be under the age of 26, according to Oregon Administrative Rules.

House Bill 2055 is headed to the House Judiciary Committee. Even if it is adopted, the bill won’t settle the existing lawsuits over ID checks because it’s not retroactive.

Officials warn SNAP users to prevent fraud

Oregonians who receive supplemental federal food benefits need to be more vigilant than ever against fraud, officials say: If their monthly benefits are stolen, they’ll be gone for good.

In the past, the federal government replaced benefits lost to fraud, but that policy changed late last year. The federal government is no longer replacing stolen benefits from the Supplemental Nutrition Assistance Program.

That could mean a total loss of tens of thousands of dollars in SNAP benefits in Oregon, primarily through “skimming,” according to officials from Partners for a Hunger-Free Oregon. That happens when a device is inserted into a credit card reader and steals financial information when the card is run through the reader.

Only a small minority lose their benefits this way. Oregon has nearly 447,000 households receiving SNAP benefits. From Oct. 1 through Dec. 20, nearly 200 households had their benefits stolen, losing $77,000 in food aid.

The average household receives $310 in SNAP benefits, which are not meant to foot an entire food bill, but the money is often crucial for those who need it.

Jake Sunderland, press secretary for the Oregon Department of Human Services, said SNAP users should take several precautions to protect themselves from fraud:

- Only manage your account through the ebtEDGE website or mobile app, which can be downloaded from the Apple App Store or Google Play.

- Freeze your card right away after each use and unfreeze it before you make purchases and block purchases made outside of Oregon or online through Cardholder.ebtEDGE.com.

- Keep your PIN secret and cover the keypad when you enter it.

- Check your account activity regularly and cancel your card immediately if you see purchases you didn’t make. (SOURCE)

State lawmakers are considering banning winners of large prizes in the Oregon Lottery from reselling their tickets in order to block schemes that enable tax evasion and uncollected child support payments.

The sales practice has spawned a cottage industry of so-called lottery discounters who operate around the state. They annually buy millions of dollars in winning tickets – mostly video lottery and keno tickets with prizes above $1,500 – from their original winners at steep discounts. Then they claim the face value of the prizes when they present the tickets at lottery payment centers in Wilsonville and Salem.

As detailed in an investigation published last summer by The Oregonian/Oregon Live, the scheme enables tax evasion. It allows some winners to avoid past due child support and other debts to the state that would otherwise be garnished from their prizes. It can incentivize sketchy operators to manipulate winners into selling tickets. And in some states, it has been linked to money laundering.

Oregonians looking to renew their vehicle registration and get new tags can now do so at a handful of Fred Meyer stores around the state

The self-service express kiosks from Oregon Driver and Motor Vehicle Services are designed to give Oregonians another way to renew their registration besides at a DMV office, online or by mail, according to a news release.

The kiosks are located in Fred Meyer locations in Salem and Eugene as well as in Beaverton, Bend, Happy Valley, Hillsboro, Medford, Oak Grove and Tualatin. A location in Portland is coming soon and the DMV said it plans to offer more kiosks around the state in the future.

In Salem, the kiosk is at the Fred Meyer located at 3740 Market St. NE and allows users to pay by cash, credit or debit card. In Eugene, it’s located at the Fred Meyer at 3333 W 11th Ave. and will only allow payment via debit or credit card.

“We see these kiosks as a way to improve customer service, access and equity,” DMV administrator Amy Joyce said in the news release. “This program is the latest effort aimed at improving the DMV experience for our customers.”

The kiosks are ADA-accessible and registration renewal can be completed in English and Spanish. Users will be charged a $4.95 vendor fee for each transaction.

Customers will need to bring identification (license, permit, or ID card), insurance information and registration renewal notice. — Vehicle registration cards and license plate stickers will be printed after the transaction.

Registration Is Now Open For The Bob Ross-inspired Happy Little (Virtual) 5K Run for the Trees

Oregon Parks Forever — Inspired by American painter and PBS television personality Bob Ross’ love of the outdoors, Oregon Parks Forever is sponsoring a virtual 5K race to help plant trees in Oregon’s parks & forests. Registration is now open for the 2025 Run for the Trees at www.orparksforever.org.

Participants can run, walk, hike, skate, paddle or roll to complete their 5K anywhere outdoors anytime between April 19 and 27 (covering Earth Day and Arbor Day). Participants are encouraged to register by April 1 to ensure that your swag arrives before the event week. If you register after April 1, you may not receive your swag before race week. Registration will close on April 15.

For $36 per person, each participant will receive a keepsake Happy Little T-shirt, a commemorative bib number and a finisher’s medal. All Oregon race proceeds support tree planting and forest protection efforts in Oregon parks. Ten trees will be planted in Oregon for each registration.

Gather your friends, family and/or colleagues and create your own walk or run. Make it fun!

Initially, the “Happy Little Trees” program began with a partnership between the Michigan Department of Natural Resources and Bob Ross Inc., with hundreds of volunteers helping to plant “happy little trees” at locations hard-hit by invasive pests and tree diseases. The partnership quickly expanded to include the Run for the Trees / Happy Little (Virtual) 5K.

As the Happy Little 5K gained popularity, more states have joined the effort. Now in its fifth year, the Happy Little 5K has expanded its reach to include ten other states. Together, Michigan, Oregon, Florida, Georgia, Indiana, Ohio, Pennsylvania, South Carolina, Wisconsin, Maryland and Virginia will “lock arms” as they help raise awareness and funding for stewardship efforts in each state’s parks.

“We are thrilled to partner with Bob Ross, Inc. and these other ten states on the Happy Little 5K concept as a way to honor the late Bob Ross and create a legacy event to plant trees,” said Seth Miller, Executive Director of Oregon Parks Forever.”

Oregon Parks Forever joined this event as an expansion of our efforts to fund the replanting of trees killed by wildfires, heat domes and invasive insects. Over the past three years, Oregon Parks Forever has been able to fund the replanting of more than 800,000 trees across Oregon.

“The official Bob Ross 5K is probably our most favorite initiative,” says Joan Kowalski, president of Bob Ross Company. “It’s the perfect blend of everything Bob held dear; nature, taking care of the environment, and happy trees too of course. He would have been so pleased to see how it’s getting so popular around the world.” — Learn more about the program at http://www.orparksforever.org

IRS Direct File, Direct File Oregon Will Be Available When Income Tax Return Processing Begins January 27

Salem, OR— Free electronic filing through the combination of IRS Direct File and Direct File Oregon will open January 27 when both the IRS and the Oregon Department of Revenue begin processing e-filed 2024 federal and state income tax returns. Paper-filed return processing will begin in mid-February.

Taxpayers are encouraged to use the IRS Eligibility Checker to see if they qualify to file directly with the IRS and the state.

E-filed returns will be processed in the order they are received. However, as in years past, the department won’t be issuing personal income tax refunds until after February 15. A refund hold is part of the department’s tax fraud prevention efforts and allows for confirmation that the amounts claimed on tax returns match what employers and payers report on Forms W-2 and 1099.

E-filing is the fastest way for a taxpayer to get their refund. On average, taxpayers who e-file their returns and request their refund via direct deposit receive their refund two weeks sooner than those who file paper returns and request paper refund checks.

The department reminds taxpayers that taking a few easy steps in the next few weeks can make preparing their 2024 tax return easier in 2025.

Free filing options open January 27 — In addition to IRS Direct File and Direct File Oregon, other free filing options will also open January 27. Free guided tax preparation is available from several companies for taxpayers that meet income requirements. Free fillable forms are available for all income levels. Using links from the department’s website ensures that both taxpayers’ federal and state return will be filed for free.

Free and low-cost tax help — Free tax preparation services are available for low- to moderate-income taxpayers through AARP and CASH Oregon. United Way also offers free tax help through their MyFreeTaxes program. Visit the Department of Revenue website to take advantage of the software and free offers and get more information about free tax preparation services.

Voluntary self-identification of race and ethnicity information — New for 2025, Oregon taxpayers and Oregonians can voluntarily provide information about their race and ethnicity on Form OR-VSI when they file their 2024 taxes. Providing this information may be done separately from a tax return through Revenue Online. The information will be confidential. It can only be used for research purposes to analyze potential inequities in tax policy. The new option is a result of Senate Bill 1 in 2023.

Use Revenue Online to verify payments — Taxpayers can verify their estimated payments through their Revenue Online account.

Through Revenue Online, individuals can also view letters sent to them by the department, initiate appeals, make payments, and submit questions. Visit Revenue Online on the Revenue website to learn more.

Those who don’t have a Revenue Online account can sign up on the agency’s website.

To check the status of their refund after February 15, or make payments, taxpayers can visit Revenue’s website. You can also call 800-356-4222 toll-free from an Oregon prefix (English or Spanish) or 503-378-4988 in Salem and outside Oregon. For TTY (hearing or speech impaired), we accept all relay calls.

Department Of Revenue Volunteers Will Help Taxpayers Use Direct File Oregon To E-file Their Taxes For Free At Libraries Across The State

Salem, OR—Oregonians looking for assistance in electronically filing their taxes for free, could find help as close as their local library this tax season.

Volunteers from the Oregon Department of Revenue will be traveling to libraries in 17 different communities across the state in February, March, and April to assist taxpayers in using the free combination of IRS Direct File and Direct File Oregon to complete their returns.

The one-day tax help clinics are planned at libraries in:

| Bandon | North Bend |

| Burns | Prineville |

| Coquille | Pendleton |

| Cornelius | Roseburg |

| The Dalles | Salem |

| Klamath Falls | Seaside |

| Lebanon | Sweet Home |

| McMinnville | Toledo |

| Tualatin |

Dates, times, and addresses for each clinic can be found on the Free Direct File assistance at local libraries webpage.

Last year, more than 140,000 taxpayers in 12 other states filed their federal tax returns using a limited IRS Direct File pilot program while nearly 7,000 Oregon taxpayers filed their state returns using the free, state-only Direct File Oregon option.

The U.S. Department of the Treasury announced in May that it would make IRS Direct File a permanent option for taxpayers and invited all 50 states to participate. Oregon was the first of 13 new states to accept the invitation from the IRS in June creating a seamless free e-filing system for both federal and state taxes.

With the two direct file systems connected, the IRS estimates that 640,000 Oregon taxpayers will be able to e-file both their federal and state returns for free in 2025.

The department believes that offering free assistance will help maximize the number of Oregonians who choose to use the new free option and make it possible for many who don’t have a filing requirement to file and claim significant federal and state tax credits for low-income families.

For example, the IRS estimates that one in five Oregon taxpayers eligible to claim the federal Earned Income Tax Credit are not doing so. One Oregon organization estimates that the unclaimed credits have totaled nearly $100 million in recent years.

Taxpayers should use the IRS eligibility checker to see if they’ll be able to use IRS Direct File and Direct File Oregon. Eligible taxpayers should set up an IRS online account and an account with Oregon’s Revenue Online before they come to an event. Taxpayers attending an event should bring the following information with them.

- Social security card or ITIN for everyone on your tax return

- Government picture ID for taxpayer and spouse if filing jointly (such as driver’s license or passport)

Common income and tax documents

- Forms W2 (wages from a job)

- Forms 1099 (other kinds of income)

- Form SSA-1099 (Social Security Benefits)

Optional documents to download

- Canceled check or bank routing and account numbers for direct deposit

- Last year’s tax return

Taxpayers can signup for the new “Oregon Tax Tips” direct email newsletter to keep up with information about tax return filing and how to claim helpful tax credits.

AARP Foundation Tax-Aide Sites Open in Oregon: Program Provides Free Tax Prep to Thousands of Older Adults

AARP Foundation Tax-Aide is providing free preparation now through April 15 throughout Oregon. Started in 1968, Tax-Aide is the nation’s largest free, volunteer-based tax assistance and preparation program and has served more than 80 million people. For the 2024 tax season, nearly 28,000 volunteers helped almost 1.7 million taxpayers, 965,000 of whom were adults over 50 with low income. Tax-Aide is offered in conjunction with the IRS, and AARP membership is not required.

“During the 2024 tax season, AARP Foundation Tax-Aide volunteers completed over 19,400 federal returns and 18,500 state returns in Oregon with refunds of nearly $39 million,” said AARP Oregon State Director Bandana Shrestha. “Even modest refunds can make an impact on financial resilience, especially for vulnerable older adults. AARP Foundation Tax-Aide helps put money back in the pockets of Oregonians every year by making sure they don’t miss out on the credits and deductions they have earned.”

Tax-Aide volunteers provide free tax preparation and filing services to all with a focus on adults with low to moderate income. Volunteers are trained and IRS-certified every year to ensure they understand the latest changes to the U.S. Tax Code.

AARP Foundation Tax-Aide offers a variety of options to better meet the needs of taxpayers. Access to the different types of assistance varies by location.

- In-Person Service: Tax preparation is completed by an IRS-certified Tax-Aide volunteer on-site in one visit.

- One-Visit Scan: Tax documents are scanned at the Tax-Aide site and then Tax-Aide volunteers prepare the return remotely.

- Two-Visit Scan: Tax documents are scanned at the Tax-Aide site and then volunteers prepare the return remotely. During a second visit, taxpayers work with a volunteer to finalize their return and obtain a printed copy for their records.

- Drop-Off Service: Tax documents are left at the Tax-Aide site with a volunteer and the return is prepared remotely. During a second visit, taxpayers work with a volunteer to file their return and obtain a printed copy and their original documents.

- No Site Visit Required (Internet Access Required): Taxpayers upload tax documents to the IRS-provided software. Tax-Aide volunteers prepare the return remotely and work with the taxpayer to file the return electronically.

- Online Coaching: Taxpayers prepare their own return and receive online support from a volunteer to help them along the way.

- Facilitated Self-Assistance: Taxpayers schedule an appointment at a Tax-Aide site to work with a volunteer to complete and file their own return.

- Self-Preparation: Taxpayers prepare their own return using a software product that has been made available through the Tax-Aide website.

Users can find their nearest Tax-Aide location and assistance options through the Tax-Aide site locator. The site locator features a Tax-Aide chat bot that can help book an appointment, answer questions about the program, and transfer the conversation to a live agent if needed or requested. For more information, including which documents to bring to the tax site, visit aarpfoundation.org/taxaide or call 1-888-AARPNOW (1-888-227-7669)

https://www.facebook.com/groups/1109674113319848

Call us at 541-690-8806. Or email us at Info@RogueValleyMagazine.com